The foreign exchange (forex) market is the largest and most liquid financial market in the world, with an average daily trading volume exceeding $7 trillion. Unlike traditional stock markets that operate within fixed hours, the forex market functions 24 hours a day, five days a week. This round-the-clock trading environment is made possible by a decentralized system consisting of major financial centers across different time zones. Understanding forex market hours is crucial for traders looking to optimize their strategies and capitalize on market movements.

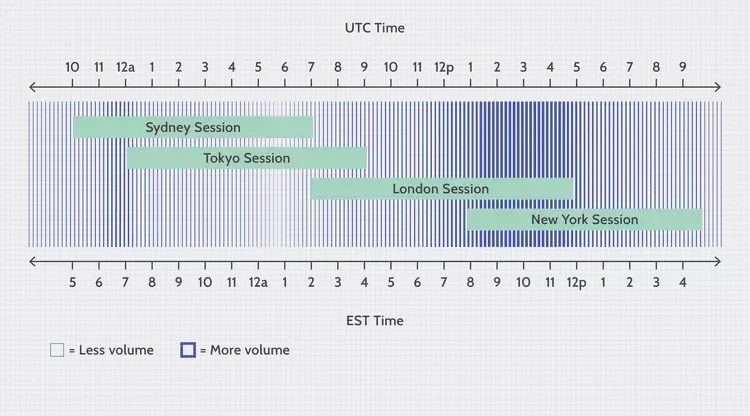

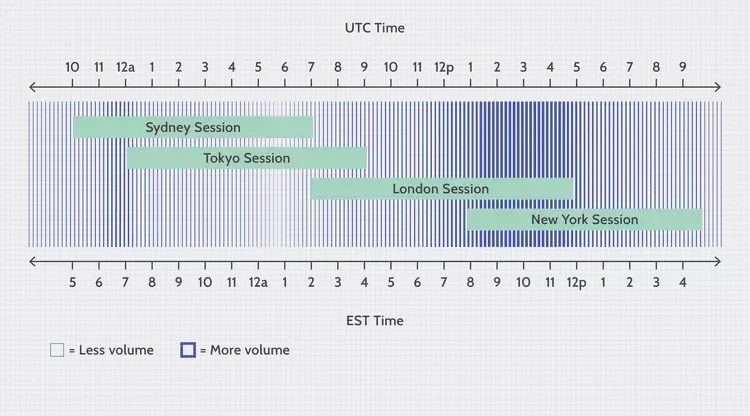

The forex market operates through four primary trading sessions: Sydney, Tokyo, London, and New York. Each session corresponds to major financial hubs and overlaps with others, creating periods of high liquidity and volatility. Below is a breakdown of each session:

1. Sydney Session (10 PM – 7 AM GMT)

The Sydney session marks the start of the forex trading week on Sunday evening. While it is not the most active session, it sets the tone for the market, particularly in the Asia-Pacific region. The Australian dollar (AUD) and New Zealand dollar (NZD) see heightened activity due to regional economic news and events.

2. Tokyo Session (12 AM – 9 AM GMT)

The Tokyo session follows Sydney and represents the start of major market activity. Japan is a financial powerhouse in forex trading, with the yen (JPY) being one of the most traded currencies. High liquidity is observed in JPY pairs, particularly USD/JPY, EUR/JPY, and GBP/JPY. Economic reports from Japan and China significantly impact market movements during this session.

3. London Session (8 AM – 5 PM GMT)

The London session is the most active forex trading session, as London is a global financial hub. Approximately 35% of daily forex transactions occur during this session. High liquidity leads to tighter spreads and increased price action, making it an attractive window for traders. Major currency pairs like EUR/USD, GBP/USD, and USD/CHF experience the most volatility. Economic releases from the UK and the Eurozone often drive significant price fluctuations.

4. New York Session (1 PM – 10 PM GMT)

The New York session is the second-largest forex trading session and overlaps with the London session for several hours, creating substantial market activity. The US dollar (USD) plays a dominant role, as it is involved in the majority of forex transactions. Economic reports, Federal Reserve announcements, and Wall Street’s stock market performance influence trading behavior during this session.

Understanding Overlaps and Their Importance

The most significant price movements occur during session overlaps when liquidity is highest. These periods present excellent opportunities for traders to enter and exit positions efficiently.

London & New York Overlap (1 PM – 5 PM GMT): The most volatile period, as two of the biggest financial centers are active. Currency pairs involving USD, EUR, and GBP experience the highest trading volumes.

Sydney & Tokyo Overlap (12 AM – 7 AM GMT): Moderate liquidity, with increased activity in AUD, NZD, and JPY pairs.

How Forex Market Hours Impact Trading Strategies

Different forex market hours favor distinct trading strategies. Understanding when to trade based on market conditions can significantly improve a trader’s success rate.

1. Scalping and Day Trading

Scalpers and day traders thrive in high-liquidity environments with rapid price movements. The London and New York overlap offers the best conditions for short-term trades due to high volatility and tighter spreads.

Swing traders, who hold positions for several days, benefit from active sessions where trends establish themselves. The London session is ideal for identifying long-term price movements, while the Tokyo session allows for position adjustments based on Asian economic developments.

Major economic reports, central bank decisions, and geopolitical events create significant volatility. Traders who focus on news events should monitor forex market hours to capitalize on major releases from the US (New York session), Europe (London session), and Asia (Tokyo session).

Carry traders, who profit from interest rate differentials between currencies, should consider market hours when central banks announce rate decisions. The Sydney and Tokyo sessions are particularly relevant for trading pairs like AUD/JPY and NZD/JPY, which involve high-yielding currencies.

Best Times to Trade Forex

While the forex market is open 24 hours a day, certain periods offer better trading conditions than others. The best times to trade include:

Worst Times to Trade Forex

Understanding forex market hours is crucial for developing effective trading strategies. Each session offers unique trading opportunities based on liquidity, volatility, and market activity. By aligning trading strategies with the most active market hours, traders can maximize profitability while minimizing risk. Whether engaging in short-term scalping or long-term swing trading, knowing when to trade can be the difference between success and failure in the forex market.